Transcript

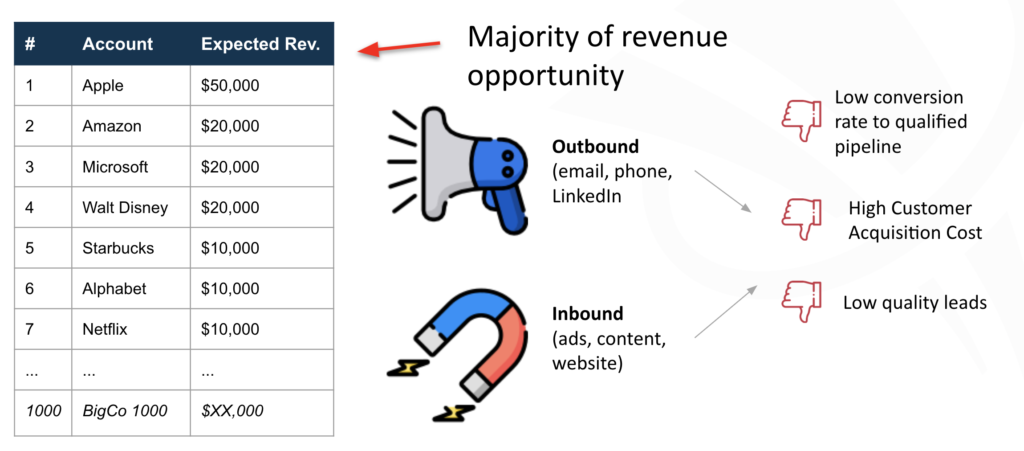

Let’s assume that you’re targeting B2B companies and you built out your account list. And if you have a heavy ABM strategy, those accounts probably represent the vast majority of your potential revenue. So how do you go about converting that opportunity into conversations and qualified pipeline? Generally it all boils down to some combination of inbound and outbound funnels; but what if you’re not getting them to convert?

Just because you’re doing ABM doesn’t necessarily mean you’ll magically alleviate the common B2B funnel problems, such as low conversion rates, qualified pipeline, high customer acquisition costs and low quality leads.

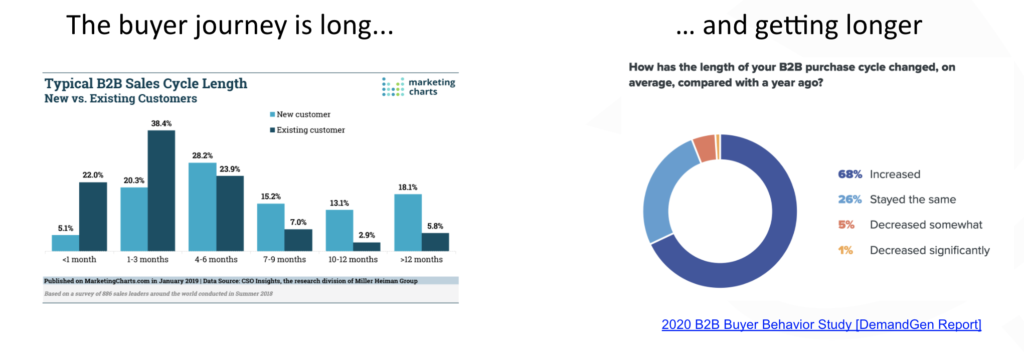

When you’re facing this, it’s very easy to be critical of the factors that are under your control, like messaging, campaigns or list building. But it’s also very often the case that there are factors outside of your control. Most notably buyer behavior. It’s relatively well known that the buyer journey in B2B is long, especially for net new customers. And it’s only getting longer.

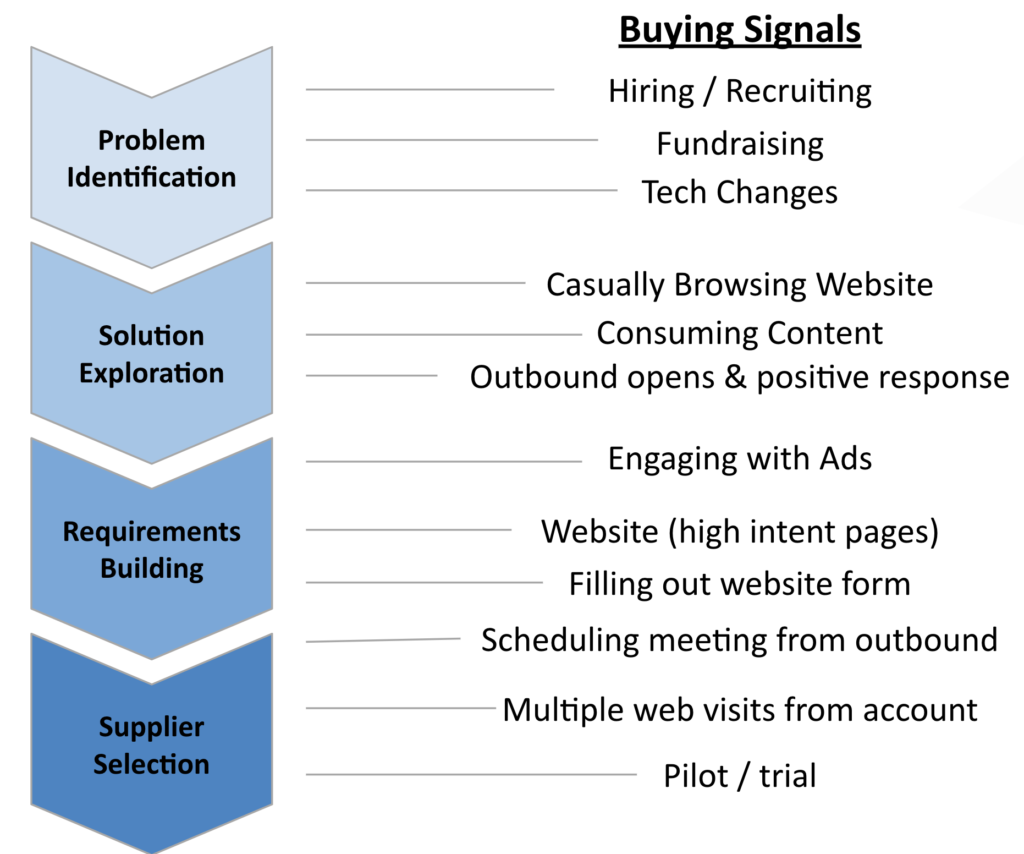

There are a lot of frameworks that try to describe buyer behavior, and they all look something like this.

This is what we and the experts out there think buyers are doing when they’re going through a purchase decision.

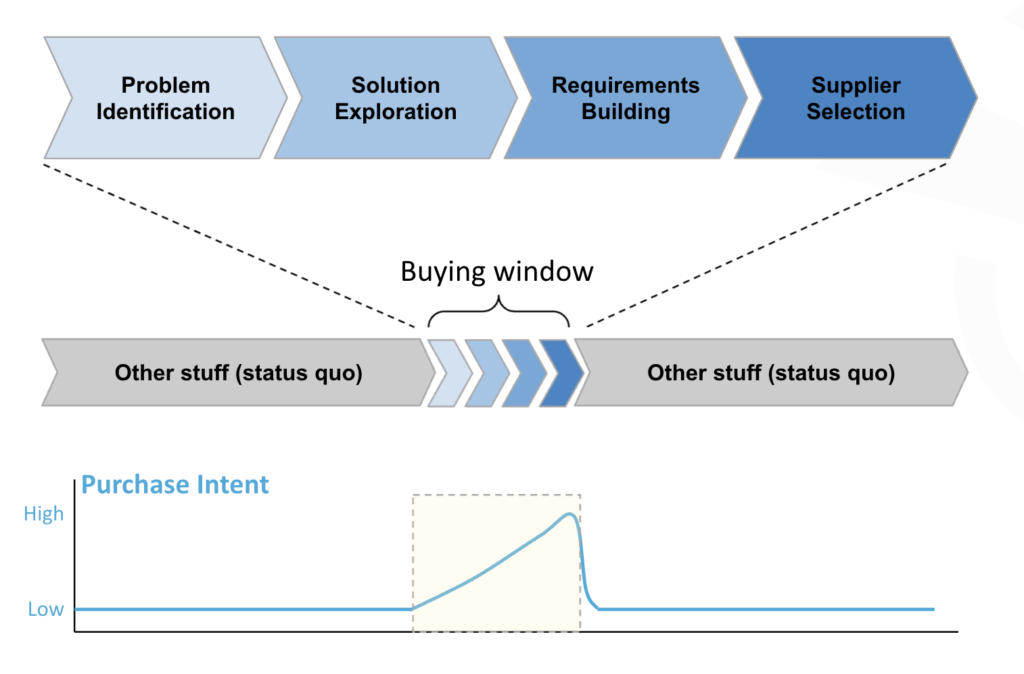

I think that’s a somewhat limited view. Let’s zoom out a little bit to understand our buyers over a longer period of time, not just when they happen to be looking for products or services. The reality is that outside of this relatively short buying window, they’re not thinking about you at all. In fact, they’re likely doing other stuff like executing projects, managing their teams, or, after they’ve actually made a purchase decision, implementing the solutions that they selected with no immediate need to find another one.

If you think about this in terms of actual purchase intent of the buyer, it’s usually quite low for anything that has a significant price tag associated with it.

Usually we only see it shift dramatically within that buying window. This doesn’t mean that you completely ignore accounts that are outside of the buying window, but it does suggest that you’re more likely to see buying motions within it when they have higher purchase intent.

Of course, an important point here is that unlike account selection, campaigns offers purchase intent is largely outside of your control. It starts when buyers become aware of a problem or solution and it progresses from there. So your goal is to engage them in a conversation as early in that process as possible.

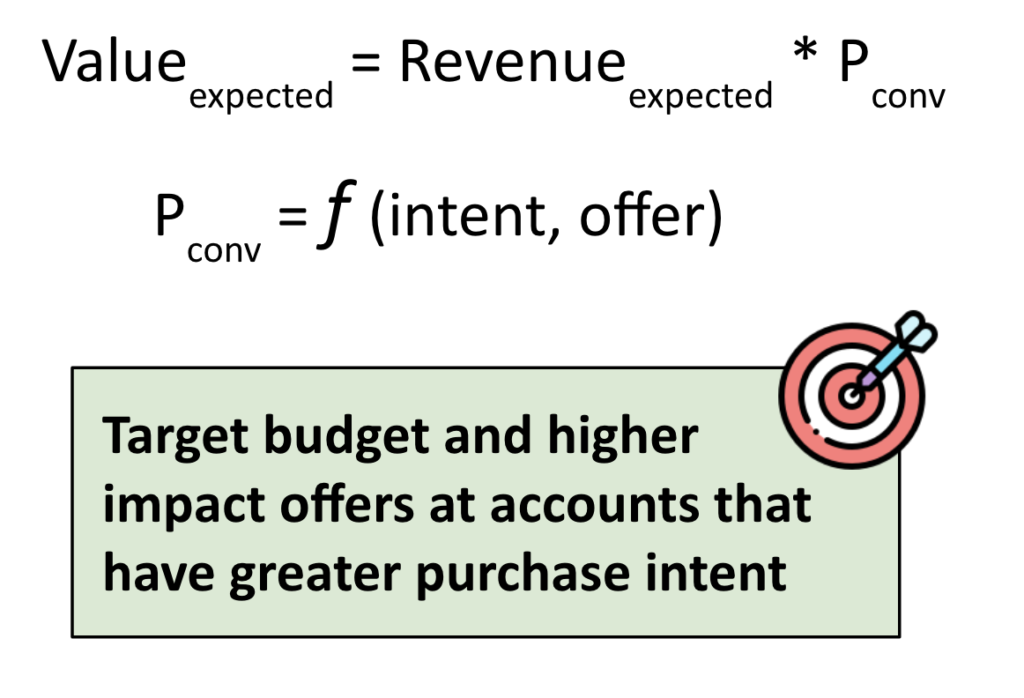

What’s the value of the purchase intent within the buying window? Let’s do some funnel math to solve for it. The expected value of an account at any point in time can be modeled as the revenue expected from that account, either on an LTV or annual contract value basis multiplied by the probability of conversion at that point in time.

From our experience the probability of conversion to opportunity is largely determined by the customer’s purchase intent and the offer that you put in front of them. What if you could allocate more budget and therefore create higher impact offers to those high in 10 accounts that are within the buying window?

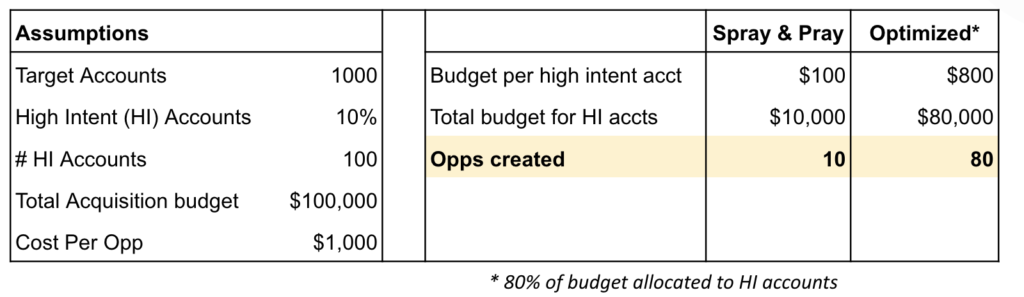

There are several ways to model this, but here’s one approach. In it we assume some percentage of the total accounts that you’re targeting are in the buying window at any point in time, that you have a fixed budget for acquisition and you’ve established an average cost to generate an opportunity from your accounts.

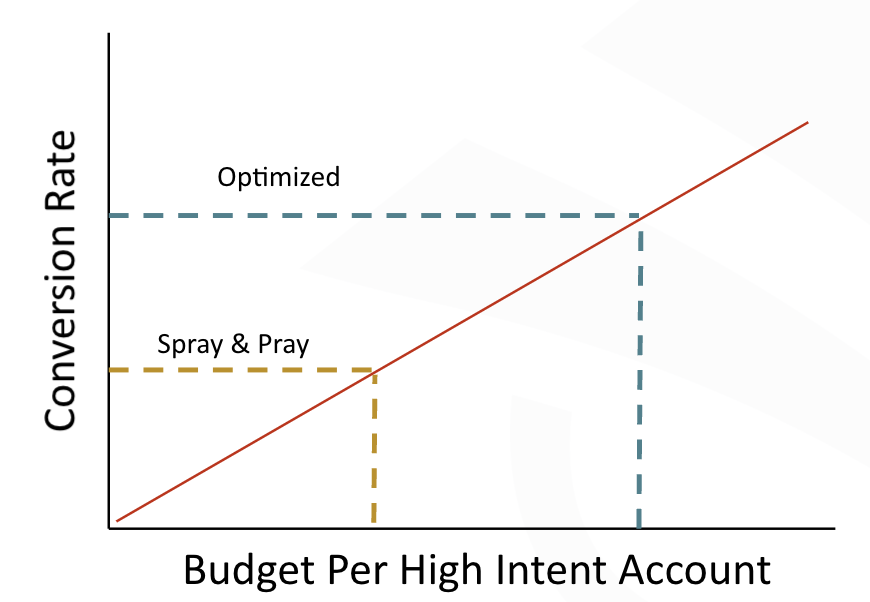

If you’re distributing that budget evenly across all of your target accounts, irrespective of their intent (known as the spray and pray model), then you have less total budget available for those high in 10 accounts. If however, you’re able to focus and optimize, so that 80% of your budget is focused on the high intent accounts and 20% on the rest, then you’re able to actually generate eight times more opportunities from accounts that are in that buying window because of the higher spend.

Of course this assumes that there’s a correlation between the budget you can spend per account and the conversion rate, which in this case is a sales conversation. Now, typically that involves higher touch and more expensive plays like high touch outreach, personalization, increased PPC bids or direct mail.

But if you are confident that you can generate more conversions at high intent accounts by focusing your budget and spend, the next step is being able to identify when an account starts showing intent. To understand this, we can think about all the various activities buyers go through when they go through your purchase stages. That could be everything from internal activities, like recruiting and fundraising and coming to your website, engaging with your content ads and outbound campaigns and actually filling out forms and piloting solutions.

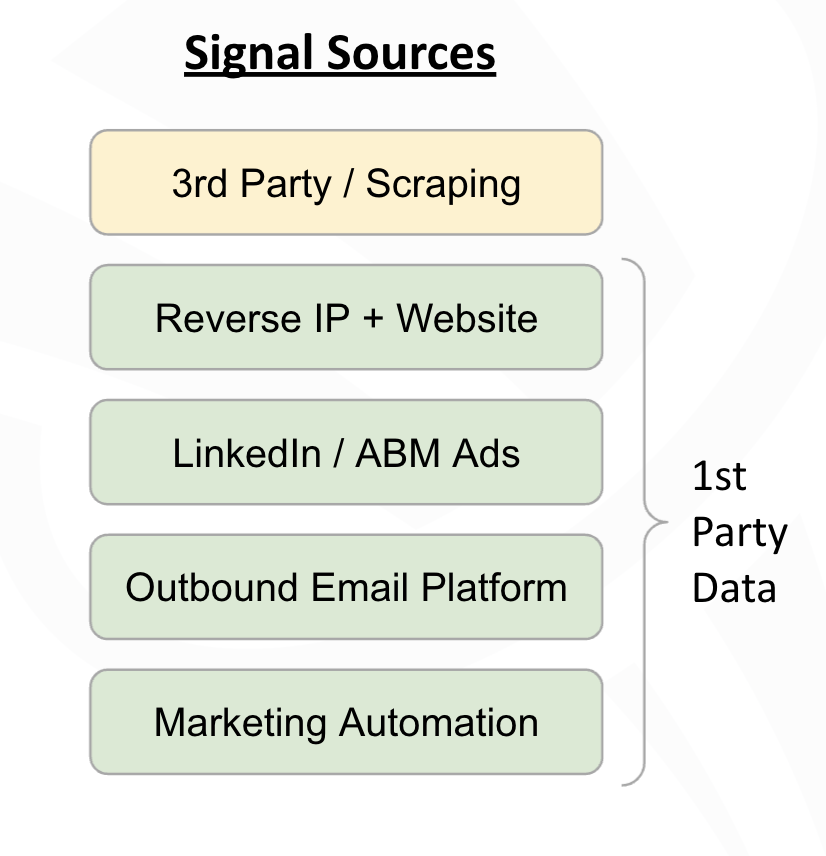

All of these are signals that can be captured and tracked by different sources from third parties to analytics and marketing automation platforms. And although intent data is often discussed as something you buy exclusively from a third party, recognize that most of these are first party data sources often siloed away. General intent is useful, but it’s actually more important to establish an intent for your specific product or service.

Our recommendation is before you run out and buy expensive third party intent data, make sure you’re fully taking advantage of your first party data sources that can help you try and triangulate buyer intent. The final point here is even if we’re running ABM campaigns, the traditional conversion points, when a customer fills out a form on your website or schedules meeting from an outbound campaign, can be way too late in the journey. Any sales rep is going to tell you that the earlier they can engage that account, who’s entering the buying window, the better they can control the conversation. And if you don’t do that, your competitors sure will.

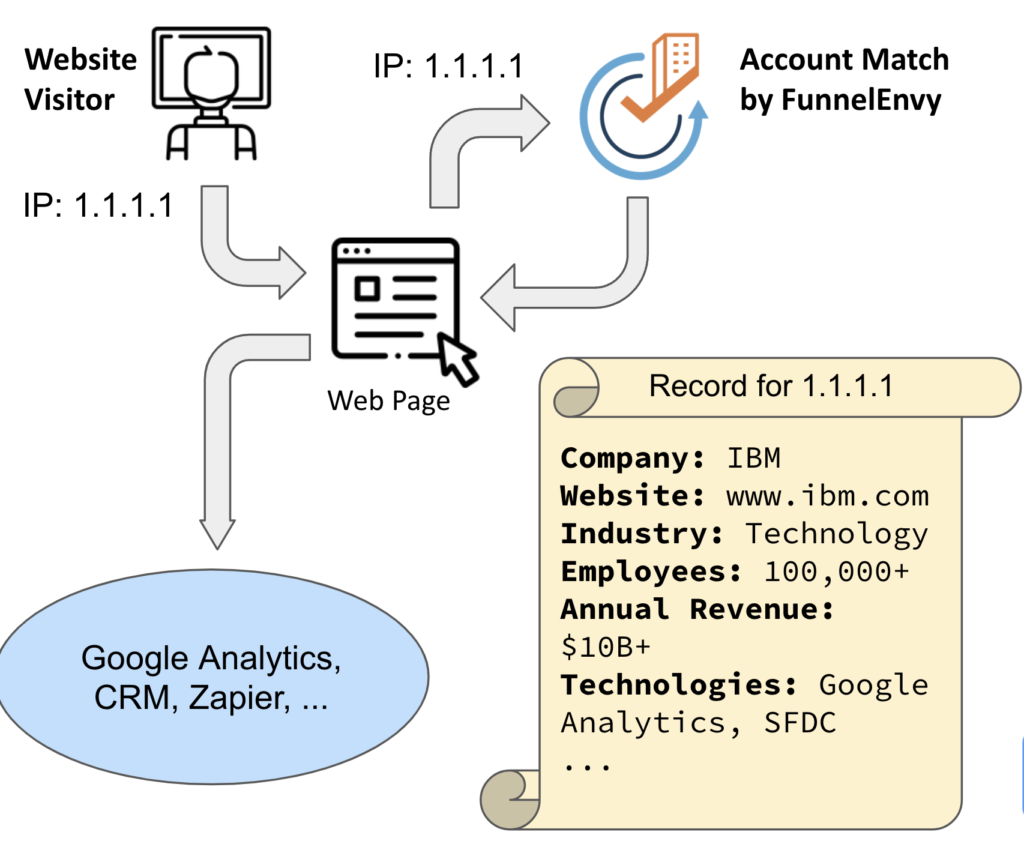

So if we’re not waiting for prospects to fill out forms, how do we identify them? Well, your website is probably your most important source of intelligence and you own it. Knowing who’s coming to it, how they got there and what content they’re consuming can tell you a lot about their purchase intent. So one way you can identify so-called anonymous visitors before they fill out a form is through what we call reverse IP.

Let’s walk through how it works. Every website visitor coming to your site requests pages from the site, and with that sends their IP address. That’s the key. Now various services, including AccountMatch by FunnelEnvy can turn that IP address into an account record. And that account record contains various firmographic attributes like the company website, industry number of employees, revenue ranges, and potentially even the technologies that they’re using.

AccountMatch isn’t the only solution out there. There are plenty of other services that also provide the same capability. The important point is that record can be pushed back to your webpage and also to various analytics tools, your CRMs, Zapier or anyone else that needs to go. So again, account match determines firmographic or account level attributes based on that visitor’s IP address. Here’s a couple of things you should know about them. First off, as I mentioned, they work for anonymous visitors, and don’t rely on someone filling out a form on your site.

They will not match a hundred percent of traffic. Match rates typically vary around 10 to 30%. It can vary significantly based on the nature of the traffic coming to your site. The good news is that for larger organizations with known IP blocks, you tend to see much higher, effective match rates. That’s good because most of the time in our high value target accounts, tend to be comprised of larger organizations. Finally, some of the providers tend to be better at real time responses and it allows for not just intelligence, but also targeting and personalization on your website.

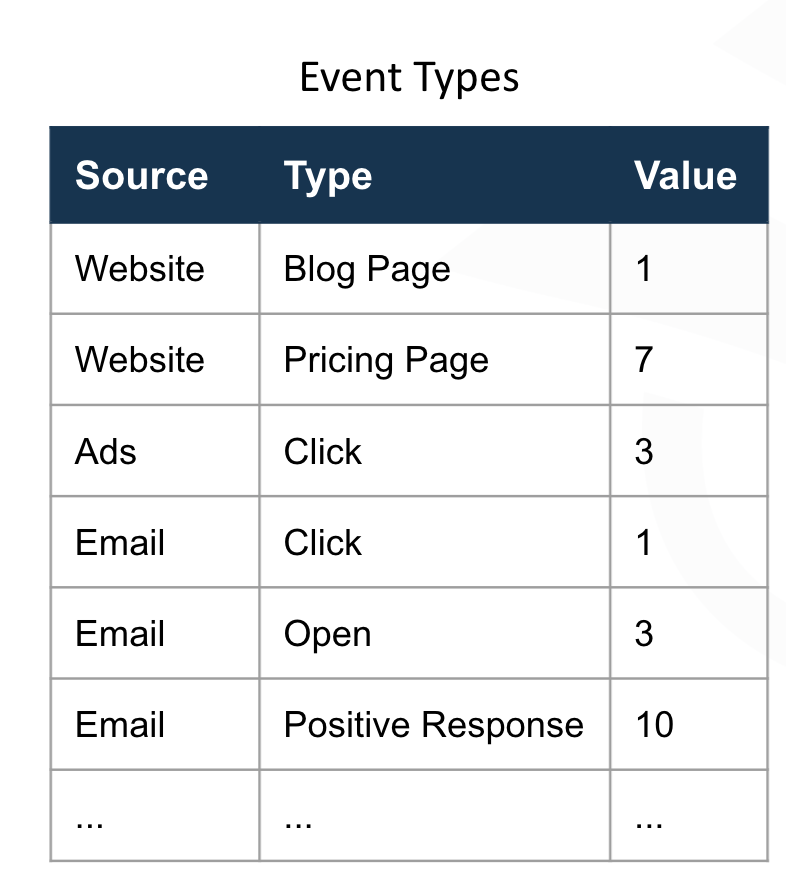

So one of our goals then is to be able to quantify the intent of any account by generating an intent score for each of those accounts. This obviously starts with our target account list or our TAL, which includes within it, the expected revenue for each account. To score these, what we need to be able to do is factor in the various different buying signals we reviewed on the earlier slide. We can model all of these as events, each of which has a source, a type and a score value associated with it.

As you can see a source like the website can have different event types, with different scores associated with them. For example, filling out a blog page generally indicates less intent than viewing a pricing page or filling out a form. Similarly, you can model out all the various different types of events from multiple sources that are relevant to your buying journey. As far as the scores themselves, you can start by taking educated guess at them, using your analytics and attribution models as well as your intuition to guide you. If you do have submission volume, you can also take predictive machine learning, one to one approaches to generate scores as well. Once you are capturing events from your sources and you can tie them back to accounts, you sum those over a period of time to get an overall view and then normalize those across accounts to get a relative account score from zero to one.

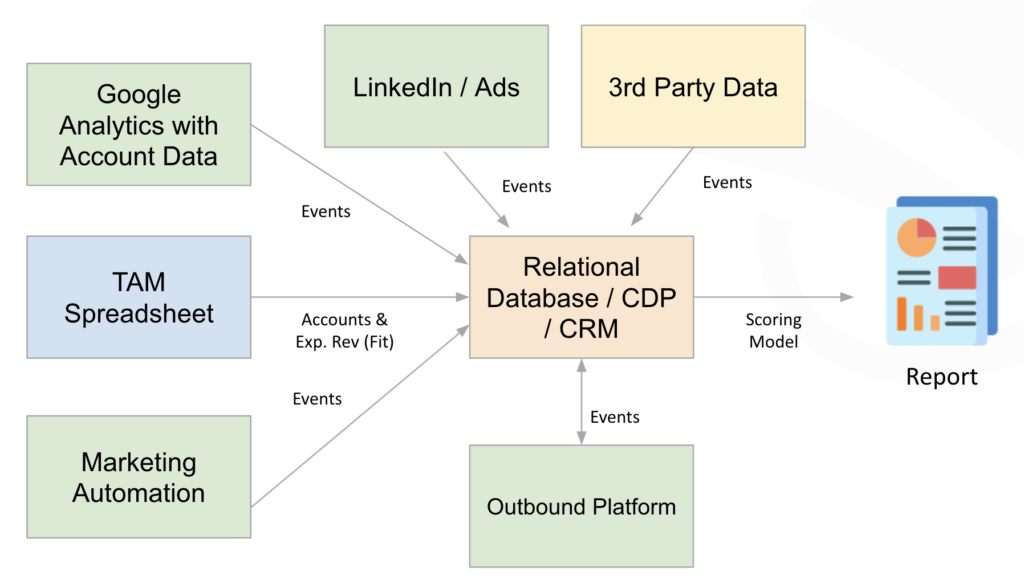

To actually integrate those events and set things up correctly, you’ll need a database of some kind in the middle. This can be a traditional relational database, a customer data platform, or even your CRM if it’s flexible enough to accommodate this. You’re going to start by feeding it your TAM spreadsheet, which includes your accounts and expected revenue or a fit score. And then we’ll start integrating your website data. For this, we usually sync that reverse IP data as account data into Google analytics, and then send the relevant events over to the database. And then depending on your event sources, you can integrate all of them from outbound to your ads, third party data and your marketing automation platform into the same database. Finally, from that, you’d be able to run the queries, generate an account, prioritize report, showing both fit expected revenue as well as intent.

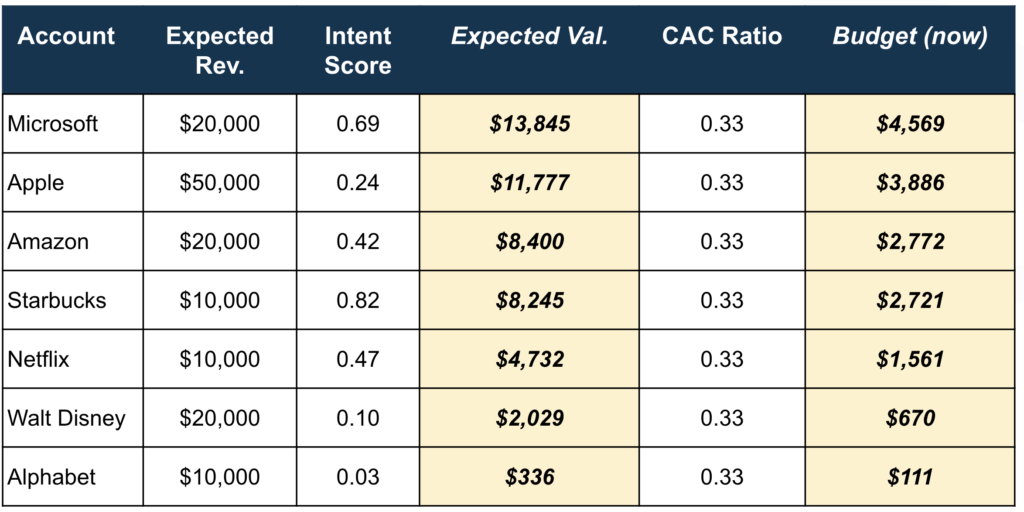

What do we actually get from this report? So we take our expected revenue from our target account list and multiply that by the intent score from the events that we came up with, to arrive at a present day expected value. That is the value in today based on all of the events and the intent that that account is shown. If you establish a customer acquisition cost ratio target, maybe a third of the ACV, or if you can come up with one, then you can establish a present day budget that you can expand for each account for acquisition.

So this is what that report could look like. Now, instead of a list of accounts that you spray and pray against you have. So what do we get from this report? Well, if we take our expected revenue from our account list and multiply that by the intent score, that score from zero to one, we can arrive at a present day, expected value per account.

That’s the value of each account in the present day based on the behaviors and the intent that they’re showing. If you established a customer acquisition cost ratio target (or if you can come up with one) then you can establish a present day budget that you can spend for acquisition per account. So this is what that report could look like. So now instead of a list of accounts that you spray and pray against, you actually have a prioritized list that has both expected value and the budget that you can use to focus your SDRs and other high cost plays at your most valuable accounts, which means the one that have both high value and are demonstrating higher intent to purchase. So sort descending by budget or expected value and prioritize accordingly.

So with that only give us some takeaways. Account based revenue funnel optimization is largely an exercise in intent based prioritization. You want to adjust your goals for low intent, inbound and outbound impression. So if an account is not showing intent, you may not want to sell them right away. Instead, you may want to build brand awareness, positioning and use it as a vehicle to evaluate intent through content. For this to work, you obviously have to be able to develop higher touch plays, both outbound and inbound to take advantage of that increased budget. But don’t silo your channels, recognize that outbound, inbound impressions whether ads, your website or outbound on emails are all an impression that can be counted towards the overall intent score. And finally, you might come up with one score, but certainly you’re going to need to be able to test, measure and iterate on the model over time.